What is the OM Stock Exchange?

The OM Stock Exchange, also known as the Osaka Securities Exchange, is a significant financial institution located in Japan. It is one of the oldest and most prestigious stock exchanges in the world, offering a platform for companies to raise capital and investors to trade stocks. In this article, we will delve into the history, structure, and role of the OM Stock Exchange, providing you with a comprehensive understanding of this vital financial hub.

History of the OM Stock Exchange

Established in 1878, the OM Stock Exchange has a rich history that spans over a century. It was initially founded as the Osaka Stock Exchange, and it played a crucial role in the development of the Japanese financial system. Over the years, the exchange has undergone several transformations, including the integration with the Tokyo Stock Exchange in 1943 and the subsequent re-establishment as the Osaka Securities Exchange in 1949.

Structure of the OM Stock Exchange

The Osaka Securities Exchange is structured as a non-profit organization, governed by a board of directors. The exchange is divided into two main segments: the First Section and the Second Section. The First Section is reserved for larger, more established companies, while the Second Section is for smaller, emerging companies. This classification helps investors identify the level of risk and potential growth associated with each company.

Here is a brief overview of the key components of the Osaka Securities Exchange:

| Component | Description |

|---|---|

| Board of Directors | Responsible for overseeing the exchange’s operations and ensuring compliance with regulatory requirements. |

| Executive Committee | Manages the day-to-day operations of the exchange. |

| Market Surveillance Department | Monitors trading activities to ensure fair and orderly markets. |

| Listing Department | Handles the process of listing companies on the exchange. |

Role of the OM Stock Exchange

The Osaka Securities Exchange plays a vital role in the Japanese economy by facilitating the trading of stocks and providing a platform for companies to raise capital. Here are some of the key functions of the exchange:

-

Capital Formation: The exchange enables companies to raise funds by issuing stocks, which in turn helps them expand their operations and create jobs.

-

Price Discovery: The trading of stocks on the exchange helps determine the fair value of securities, providing transparency and liquidity to the market.

-

Investor Protection: The exchange ensures that investors are protected by enforcing strict regulations and monitoring trading activities.

-

Market Efficiency: The exchange promotes market efficiency by providing a platform for investors to trade stocks quickly and easily.

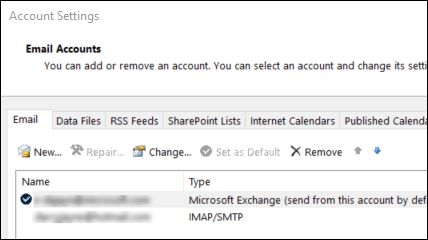

Trading on the OM Stock Exchange

Trading on the Osaka Securities Exchange is conducted through an electronic trading system called the Osaka Securities Exchange Trading System (OSES). This system allows for efficient and transparent trading, with real-time updates on stock prices and trading volumes. Here are some key features of the trading system:

-

Order Matching: The system matches buy and sell orders to ensure fair and efficient trading.

-

Real-Time Data: Investors can access real-time data on stock prices, trading volumes, and market trends.

-

Market Depth: The system provides market depth information, allowing investors to see the number of buy and sell orders at various price levels.

Conclusion

The Osaka Securities Exchange, or OM Stock Exchange, is a vital financial institution that has played a significant role in the development of the Japanese economy. By providing a platform for companies to raise capital and investors to trade stocks, the exchange has contributed to market efficiency, price discovery, and investor protection. As the Japanese economy continues to grow, the OM Stock Exchange will undoubtedly remain a key player in the global financial landscape.