Understanding the Power of American Express: A Comprehensive Guide for You

Are you curious about the ins and outs of American Express? Do you want to know how it stands out in the competitive world of credit cards? Look no further. This detailed guide will take you through the various aspects of American Express, providing you with a comprehensive understanding of what it has to offer.

What is American Express?

American Express, often abbreviated as AmEx, is a multinational financial services corporation based in the United States. It is known for its premium credit cards, charge cards, and travel-related services. The company was founded in 1850 and has since grown to become one of the most recognized financial institutions in the world.

Types of American Express Cards

American Express offers a variety of cards, each tailored to different needs and preferences. Here are some of the most popular types:

| Card Type | Description |

|---|---|

| Credit Cards | These cards allow you to borrow money up to a certain credit limit and pay it back over time, with interest. |

| Charge Cards | Charge cards require you to pay the full balance each month, making them interest-free if you pay on time. |

| Travel Cards | These cards are designed for frequent travelers, offering rewards and benefits specifically for travel-related expenses. |

| Business Cards | Business cards are designed for small business owners and entrepreneurs, offering benefits and rewards that can help manage business expenses. |

Benefits of American Express Cards

One of the reasons American Express cards are so popular is because of the numerous benefits they offer. Here are some of the key benefits:

- Travel Benefits: American Express cards often come with travel insurance, baggage insurance, and access to airport lounges.

- Points and Rewards: AmEx cards offer a rewards program where you can earn points for every dollar spent, which can be redeemed for travel, merchandise, or cash back.

- Customer Service: American Express is known for its exceptional customer service, providing 24/7 assistance for cardholders.

- Exclusive Offers: Cardholders often receive exclusive offers, discounts, and invitations to events.

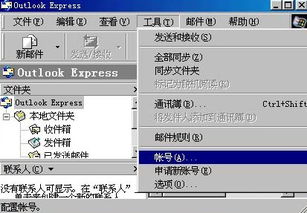

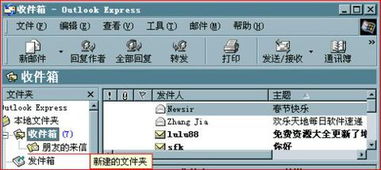

How to Apply for an American Express Card

Applying for an American Express card is a straightforward process. Here’s a step-by-step guide:

- Check Your Eligibility: Before applying, make sure you meet the eligibility criteria, which may include having a good credit score and a steady income.

- Choose the Right Card: Research the different types of American Express cards and choose the one that best suits your needs.

- Apply Online: Visit the American Express website and fill out the online application form. You will need to provide personal information, employment details, and financial information.

- Wait for Approval: Once you submit your application, American Express will review it and notify you of the decision. If approved, you will receive your card in the mail.

How to Use Your American Express Card Wisely

While American Express cards offer many benefits, it’s important to use them wisely to avoid unnecessary debt and fees. Here are some tips:

- Pay Your Balance on Time: Missing a payment can result in late fees and damage your credit score.

- Keep Your Credit Utilization Low: Try to keep your credit utilization below 30% of your credit limit to maintain a good credit score.

- Use Rewards Wisely: Make sure you’re using your rewards in a way that aligns with your spending habits and preferences.

Conclusion

American Express is a powerful financial tool that can offer numerous benefits to cardholders. By understanding the different types of cards, their benefits, and how to use them wisely, you can make the most of your American Express experience.