Ans?k Om Mecenatkort: A Comprehensive Guide

Are you considering applying for a mecenatkort, but find yourself overwhelmed by the process and the information available? Look no further. This article is designed to provide you with a detailed, multi-dimensional introduction to mecenatkort, ensuring you are well-informed and prepared.

Understanding the mecenatkort

The mecenatkort is a tax card issued by the Norwegian Tax Administration, which allows individuals to deduct certain expenses related to artistic and cultural activities. This card is particularly beneficial for those who are self-employed or work in the cultural sector.

Eligibility Criteria

Before you apply for a mecenatkort, it’s important to understand the eligibility criteria. According to the Norwegian Tax Administration, you are eligible for a mecenatkort if you meet the following conditions:

- You are a Norwegian resident or have a Norwegian tax identification number.

- You are self-employed or work in the cultural sector.

- Your income is less than NOK 600,000 per year.

- You have not previously been granted a mecenatkort.

Application Process

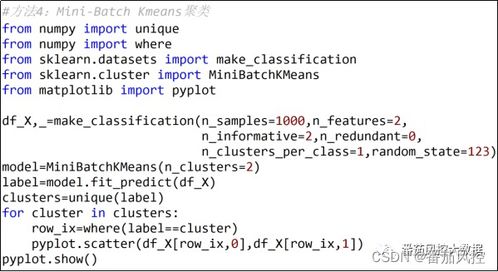

Applying for a mecenatkort is a straightforward process. Here’s a step-by-step guide:

- Visit the Norwegian Tax Administration’s website and download the application form.

- Fill out the form with accurate information and attach any required documents, such as proof of income and identification.

- Submit the application form and supporting documents to the Norwegian Tax Administration.

- Wait for the application to be processed. This usually takes a few weeks.

- Once your application is approved, you will receive your mecenatkort in the mail.

Benefits of Having a mecenatkort

Having a mecenatkort offers several benefits, including:

- Financial Savings: You can deduct certain expenses related to artistic and cultural activities, such as materials, equipment, and travel costs.

- Increased Tax Efficiency: By deducting eligible expenses, you can reduce your taxable income, potentially resulting in lower taxes.

- Recognition: Being granted a mecenatkort is a testament to your commitment to the arts and culture.

Eligible Expenses

Not all expenses related to artistic and cultural activities are eligible for deduction. According to the Norwegian Tax Administration, the following expenses are eligible:

- Materials and equipment used in artistic and cultural activities.

- Travel and accommodation expenses related to artistic and cultural activities.

- Subscriptions to artistic and cultural publications.

- Membership fees for artistic and cultural organizations.

Limitations and Restrictions

While the mecenatkort offers numerous benefits, it’s important to be aware of the limitations and restrictions:

- Only certain expenses are eligible for deduction.

- The deduction is subject to a maximum amount, which varies depending on your income.

- Expenses must be directly related to artistic and cultural activities.

Case Studies

Let’s take a look at a few case studies to better understand how the mecenatkort can benefit individuals in the cultural sector: