Understanding Your WebBank/Om Credit Report: A Detailed Guide

When it comes to managing your finances, your credit report is a crucial document that can impact your ability to secure loans, credit cards, and even rental agreements. In this guide, we’ll delve into the specifics of your WebBank/Om credit report, providing you with a comprehensive understanding of its contents and how to interpret them.

What is WebBank/Om?

WebBank, also known as WebBank/Om, is a financial institution that provides a range of services, including credit card issuing, online banking, and merchant services. They are known for their innovative approach to financial services and have a significant presence in the online lending industry.

Accessing Your Credit Report

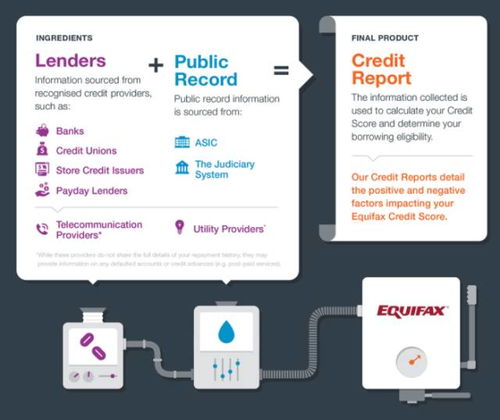

Before diving into the details of your credit report, it’s essential to know how to access it. You can obtain a free copy of your credit report from each of the three major credit bureaus鈥擡quifax, Experian, and TransUnion鈥攐nce a year. To access your WebBank/Om credit report, follow these steps:

- Go to annualcreditreport.com and enter your personal information.

- Select the credit bureau that you want to retrieve your report from.

- Review your credit report and look for the section related to WebBank/Om.

Understanding the Sections of Your Credit Report

Your credit report is divided into several sections, each providing valuable information about your financial history. Here’s a breakdown of the key sections and what they mean:

Personal Information

This section includes your name, address, Social Security number, and employment information. Ensure that this information is accurate, as discrepancies can lead to identity theft or fraud.

Account Information

This is the most critical section of your credit report. It includes details about your credit accounts, such as:

- Open Accounts: These are accounts that you currently have, such as credit cards, loans, and mortgages.

- Closed Accounts: These are accounts that you have closed, but the information remains on your report for up to ten years.

- Payment History: This shows whether you have paid your bills on time, late, or missed payments.

- Balance Information: This includes the current balance and credit limit for each account.

Public Records and Collections

This section lists any public records, such as bankruptcies, liens, or judgments, as well as any collections accounts. These can significantly impact your credit score and should be addressed promptly.

Enquiries

This section shows all the inquiries made into your credit report within the past two years. Hard inquiries, which occur when you apply for credit, can temporarily lower your score, so it’s essential to keep them to a minimum.

Interpreting Your WebBank/Om Credit Report

Now that you understand the different sections of your credit report, let’s focus on interpreting the information related to WebBank/Om:

Account Details

Look for the following details under the account information section:

- Account Number: This is the unique identifier for your account with WebBank/Om.

- Account Type: This indicates whether the account is a credit card, loan, or another type of financial product.

- Open Date: The date when the account was opened.

- Balance: The current balance on the account.

- Credit Limit: The maximum amount you can borrow on the account.

- Payment History: A record of your payments, showing whether they were on time, late, or missed.

Payment History

Your payment history is a critical factor in determining your credit score. Make sure that your payments to WebBank/Om are always on time. Late payments can negatively impact your score and may lead to additional fees or penalties.

Balance and Utilization

Your credit utilization ratio is the percentage of your available credit that you’re currently using. A lower utilization ratio is generally better for your credit score. For example, if your credit limit is $10,000 and you have a balance of $2,000, your utilization ratio is